Ecommerce Marketplace Activity September 2020

In this post we present the latest monthly analysis of GMV we’ve seen across the Volo Origin and Vision platforms and use it as a guide to help us paint the general ecommerce picture of web store and online marketplace activity. Volo customers sell across all the major retail categories on web store platforms and across around 80% of marketplace GMV, so they give us a pretty accurate steer on what’s happening in the market.

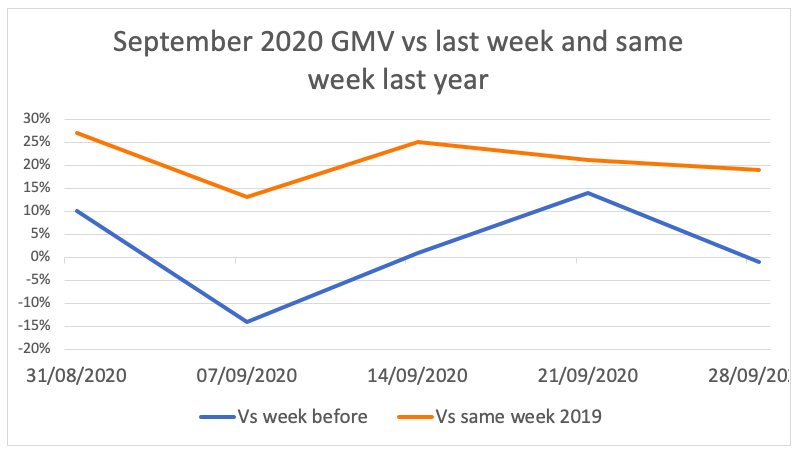

Here are the figures week-by-week for September 2020, as the industry cranks up the activity towards the Q4 peak. In our analysis we’ve taken a ‘same set’ group of established customers, in order to see the year-on-year growth as a reflection of their growth rather than our own growth. The week of 31st August includes one day from August, and the week of 28th September includes the 1st to 4th October.

- Week of 31st August, GMV was up 10% on the week before, and up 27% on the same week in 2019

- Week of 7th September, GMV was down 14% on the week before, and up 13% on the same week in 2019

- Week of 14th September, GMV was up 1% on the week before, and up 25% on the same week in 2019

- Week of 21st September, GMV was up 14% on the week before, and up 21% on the same week in 2019

- Week of 28th September, GMV was down 1% on the week before, and up 19% on the same week in 2019

We can see that with the exception of the week of 7th September, the month of September represents an extension of the plateau after the Covid bump that we saw in Q2. During this month, students returned to or started at colleges and universities, children returned to or started at schools, and retail outlets stayed open.

With the start of the academic year and a national attempt to ‘keep calm and carry on’, the second half of September witnessed a second wave of increases in virus casualties which was not reflected in a corresponding spike in ecommerce activity, at least not at the scale of the first wave. If the coronavirus trends continue their upward trajectory, and the government initiatives for the Winter and early Spring months kick in with retrenchment to outlet closures, then it seems reasonable to suggest that ecommerce will receive another shot in the arm and increase once more.

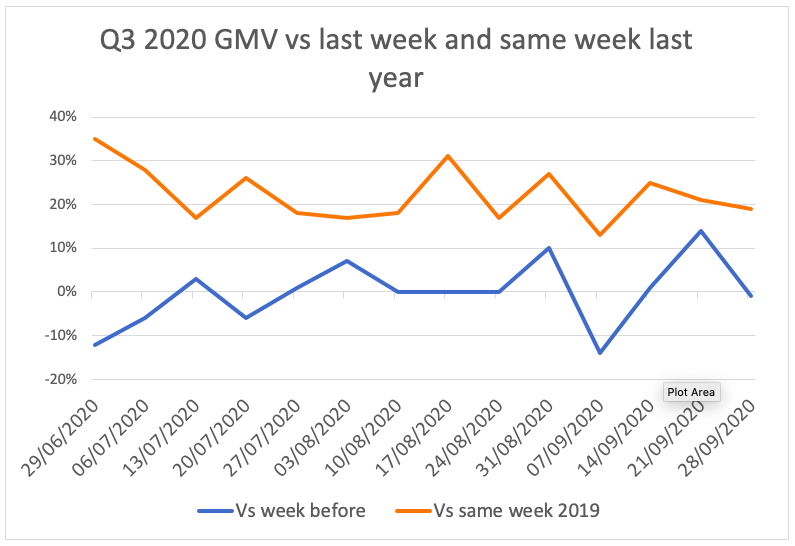

Looking at the data for September in more detail, the average growth of each week compared to the same period last year was 21%, slightly more than the 17-18% range for the weeks in August. Was that the general picture of the third quarter of 2020, compared to the bell curve effect of Q2? Let’s take a look.

Indeed, July, August and September present a consistent picture of the post-Covid spike period, with the quarter stabilising at around 20% uplift from 2019. Furthermore, as we get into the first week of October and the key quarter of the year for many in retail, we’re at a fascinating point in the year. It seems unlikely that there will be a national lock-down like we saw in Q2, yet there is so much uncertainty. Ecommerce is set for a record Q4, but just how big remains to be seen.

To discuss how you can make 2021 a year of less uncertainty than 2020, please get in touch with us here.