Ecommerce Marketplace Activity July 2020

In this post we continue our monthly retrospective of GMV we’ve seen across the Volo Origin platform and use it as a yardstick for what’s happening across marketplaces and ecommerce as a whole.

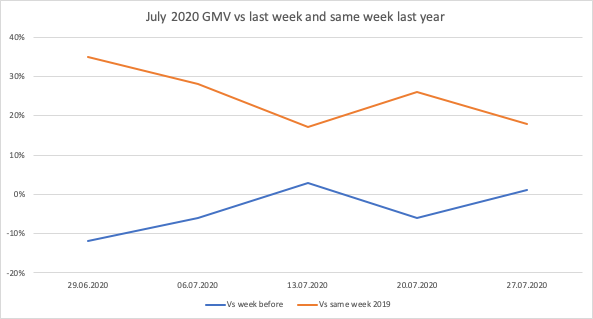

Here are the figures week-by-week for July 2020. As always, for comparison purposes we’ve taken a ‘same set’ group of established customers, to see the year-on-year growth as a reflection of their growth rather than any changes in our own customer base.

- Week of 29th June, GMV was down 12% on the week before, and up 35% on the same week in 2019

- Week of 6th July GMV was down 6% on the week before, and up 28% on the same week in 2019

- Week of 13th July, GMV was up 3% on the week before, and up 17% on the same week in 2019

- Week of 20th July, GMV was down 6% on the week before, and up 26% on the same week in 2019

- Week of 27th July, GMV was up 1% on the week before, and up 18% on the same week in 2019

July paints the picture of an economy continuing to emerge from lockdown, mirrored by an easing of ecommerce demand and the increased availability of physical retail. Weekly GMV numbers show, on balance, a gradual decline, and the growth is also gradually declining in comparison to the same week last year. At the end of July, with the vast majority of retail outlets open, ecommerce figures are still roughly a fifth higher than the same period last year. Will this be the degree of uplift we see sustained throughout 2020? It’s hard to tell.

In part this is because we only have a month or 2 of data to go on, so projections are hard to stand behind based on such scant information. We also don’t know whether further spikes of coronavirus will prompt more widespread re-lockdowns than the current regional approach we’re currently seeing. It seems reasonable to think that the UK government will follow a policy of regional reaction over retrenching to a position of national re-lockdown which would be devastating to any recovery of the overall economy.

None of these comments addresses the two long term factors at play: first, the likelihood of a winter with the annual flu recurrence coupled with a coronavirus resurgence; second, the propensity of online converts to stay shopping through the fourth quarter and into 2021.

While we all take our (predominantly) domestic holidays and plan for back to school/college and Q4 peak, we await the August ecommerce figures with interest.

To discuss where you see your own ecommerce business going, please get in touch with us here.