The Ecommerce Marketplace Picture – Second Half 2021

In July 2021 we published our semi-annual review of the first half of 2021. In this post we look back at ecommerce marketplace and web store activity for the second half of 2021 and compare it with the second half of 2020. Our data comes from marketplace and web store GMV (Gross Merchandise Volume) we see across the Volo Origin platform, as analysed and presented by the Volo Vision reporting module, and use it to judge UK ecommerce activity as a whole.

It’s worth teeing up the presentation of these figures with some words on the methodology, since statistics are often used to argue contrary conclusions, or else they’re taken out of context and end up misleading us, rather than providing enlightenment. We exclude new customers to Volo, by which we mean they’ve joined us during the last half year and weren’t with us before then. This way we don’t attribute ‘market’ growth to our own growth. We want to measure organic growth of the ecommerce industry, so we take a 3-figure set of established customers across all retail categories who were with us in the second half of 2020, to show how they’ve fared in the second half of 2021.

Of course, this analysis excludes newcomers to ecommerce, of which there would have been many over the last tumultuous 22 months. Ecommerce as a whole grew massively in 2020, and kicked on again in 2021, but what was the contribution of established sellers? How did they fare? That’s the subject of this post.

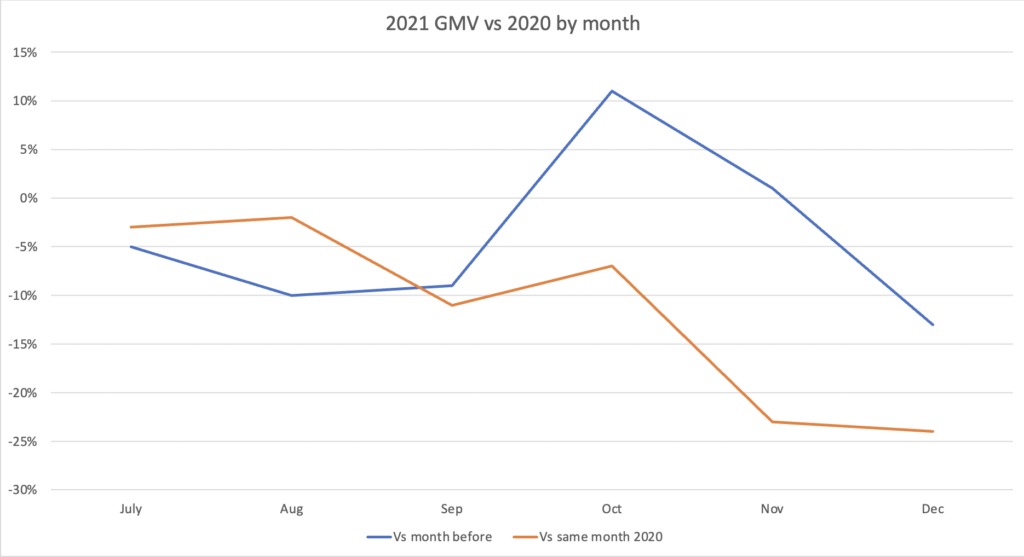

- For July 2021, GMV was down 5% on June, and down 3% on July 2020

- For August 2021, GMV was down 10% on July, and down 2% on August 2020

- For September 2021, GMV was down 9% on August, and down 11% on September 2020

- For October 2021, GMV was up 11% on September, and down 7% on October 2020

- For November 2021, GMV was up 1% on October, and down 23% on November 2020

- Finally, for December 2021, GMV was down 13% on November, and down 24% on December 2020

Let’s remind ourselves at a high level the tale of the ecommerce tape for 2020 and 2021. Q1 2020 was ‘normal’ – and we’ve not been able to use the word normal with any conviction since then. Q2 was a huge spike, Q3 tailed off slightly as restrictions were eased but was still strong, Q4 grew again as the second wave hit the UK. A few months later, in March 2021 we started to see eased restrictions as vaccination figures for the population grew. The Delta variant took hold in Q2 of 2021, and we started to see a major global pinch to the supply chain which drove up costs and raw material uncertainty markedly in the second half. Despite the third wave and the rise of the Omicron variant in late November/early December 2021, physical retail business was pretty much open for business.

July 2021 held up pretty well against 2020, down a mere 3% on the same month in 2020 and dipping 5% against the month before. August 2021, the traditional UK holiday month, saw an expected drop of 10% on the month before, but again only slipped 2% on August of 2020. A pretty strong summer for established sellers then, as they held on to the vast majority of their huge gains year-on-year.

The next two months tell a slightly more volatile story. September 2021 was down 9% on August (which was also down on July if you remember), showing the increased confidence of the UK shopper about shopping ‘outdoors’, and for the same reason was down 11% on September 2020. October 2021 GMV was very strong, rebounding back 11% against September to arrest the downward trend, and was down a mere 7% on the same time the year before. This first month of the traditional Q4 peak was impressive, given that supply was at its most unreliable and the second wave had started to hit the UK in the same period in 2020, which would have driven up ecommerce.

The last 2 months of 2021 showed the effect of UK bricks and mortar retail staying fully open. November 21 was marginally up on the month before but fell 23% against the epic November 2020. December 21 fell 13% on November, and was also down considerably on December 2020, by 24%. We can’t discount the effect of supply during the last 2 months of 2021 either, as sellers struggled with the supply of both product and staff to run their businesses.

Looking at the whole of the second half of 2021, it was an average of 11% down on the second half of 2020. Put another way, established ecommerce sellers were able to retain around 89% of the gains from an unprecedented 2020. Considering that Brexit issues were still being smoothed during the second half of the year, the EU following suit with its own tax and customs changes from 1st July 2021, and the difficulties of getting product on time and at sustainable prices, this is a great achievement.

How does 2022 look for these sellers? As cross-border trade, supply and pandemic life should begin to stabilise as the year develops, we feel that if established ecommerce businesses are able to maintain their 2021 figures this would be good result. Furthermore, a stretch target would be to get back to the total trade number for 2020.

To discuss your ecommerce plans and requirements for 2022 and beyond, please get in touch with us here.