Marketplace Activity June 2020

In this post we continue our monthly retrospective of GMV statistics across a good portion of the Volo Commerce customer base and use it as a proxy for insights about the state of ecommerce generally.

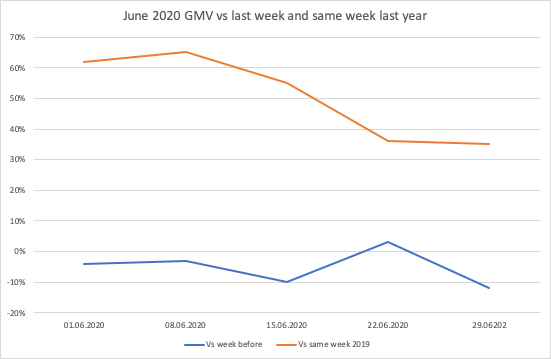

Here are the figures week by week for June. As always, for comparison purposes we’ve taken a ‘same set’ group of established customers, to see the year-on-year growth as a reflection of their growth rather than any changes in the customer base.

- Week of 1st June, GMV was down 4% on the week before, and 62% up on the same week in 2019

- Week of 8th June GMV was down 3% on the week before, and up 65% on the same week in 2019

- Week of 15th June, GMV was down 10% on the week before, and up 55% on the same week in 2019

- Week of 22nd June, GMV was up 3% on the week before, and up 36% on the same week in 2019

- Week of 29th June, GMV was down 12% on the week before, and up 35% on the same week in 2019

We can see that ecommerce performance mirrored the degree of lockdown pretty accurately. As lockdown increased from mid-March though to the end of May, ecommerce gradually increased. As restrictions eased in June and society started to re-open, we see weekly decline figures from the peaks of April and May through the month of June. These declines become more marked in the second half of June as the bricks and mortar outlets were able to open.

As we compare the weekly activities with their corresponding weeks in 2019, we see a consistent picture too. Although the year-on-year figures still show dramatic growth, from April where 2020 GMV was almost double that of 2019, we see a gradual tailing off year-on-year throughout May, which has continued in June. That said, the last 2 weeks of June were still over a third higher than the same weeks in 2019.

It has been said that ecommerce experienced a growth in market share similar to five years’ progress within the space of 5 weeks, from mid-March to the second half of April. The 2 main questions remain, however: first, at what level will the decline from peak become consolidated and start to grow, and what proportion of new customers accounting for the majority of the huge surge in online demands will continue to shop via ecommerce.

Clearly the two questions are connected. What will also come into play in the short-to-medium term is the possibility of a second spike, third spike or repeated spikes as society continues to re-open and the rules on public gatherings are gradually eased. This may well skew our assessment of the long term behavioural trend of online shopping compared to physical shopping.

For more on the long term picture for ecommerce, see here.

To discuss your own requirements for ecommerce growth, please get in touch with us here.